August 19, 2025 Okapi Partners Analyzes ISS’s 2025 Annual Global Policy Benchmark Survey

ISS recently released its 2025 Annual Global Policy Benchmark Survey. Questions cover shareholder rights, shareholder proposals, director overboarding, director pay, executive compensation, oversight of AI, board diversity, and DEI issues. A PDF of the survey can be accessed here, and the actual survey for those interested in completing it can be accessed here. The survey will close on August 22.

Survey questions provide a window into what topics are on the minds of the ISS Research team, giving insights into what policy changes may be on the horizon for the 2026 proxy season. While not every survey question means a policy will be changed (or that change is even being contemplated), there were five items that are likely of broad interest for US companies that we believe are worth highlighting.

- ISS asks for perspectives on director overboarding. There are four questions tied to this concept including overboarding thresholds for non-employee directors and public company CEOs.

Our Take: This line of questions likely signals that ISS is contemplating lowering its overboarding thresholds. ISS’s thresholds have been less strict than many institutional investors for years now (e.g., non-NEO directors are not considered overboarded until they sit on 6 total boards for ISS vs. 5 for many investors, such as BlackRock and Vanguard). If we see ISS change its policies, especially if they add a wrinkle that is less common (e.g., counting Board Chairs differently), companies will want to ensure that their current board members appreciate the new policies to avoid surprises.

2. ISS provides questions around shareholder proposals with an overarching theme of the importance of outlining company-specific rationales for why shareholders should support their proposal.

Our Take: With increased pressure on shareholder proposals, both in terms of filing and support, this line of inquiry may be an indication that ISS is also interested in applying a higher standard to shareholder proposals. At the very least, ISS may consider giving more weight to company-specific arguments, rather than just general arguments, in the supporting statements of a shareholder proposal.

3. On the executive compensation front, ISS continues to dive into the concept of time-based versus performance-based equity compensation. This review responds to increased skepticism from some investors on the use of performance-based equity which can be viewed as overly complex, costly, and sometimes not rigorous.

Our Take: It is important to note that the time-based awards being contemplated here could be materially different than the time-based awards traditionally used by companies. Specifically, ISS is asking about longer vesting periods (e.g., 5-years) and potentially combining the longer vesting periods with post vesting holding periods.

4. ISS also asks about responsiveness to low shareholder support in light of the potential for certain top holders to provide limited, direct feedback on executive compensation programs due to updated guidance from the SEC on 13G vs. 13D filings.

Our Take: This inquiry may be opening the window for companies that received lower shareholder support on their say on pay proposals (e.g., <70%) to take actions and get “credit” even if they cannot explicitly link it back to feedback the company heard from shareholders.

5. Board issues such as how ISS thinks about diversity, DEI, and AI oversight also make an appearance in the survey.

Our Take: While referencing its own pause in its board diversity policies in February 2025, ISS appears to re-examine the concepts of diversity and DEI. Responses here could have an impact on the ISS approach to not only board diversity policies but shareholder proposals tied to these issues. AI is also receiving a fair amount of attention and may signal ISS is either thinking of incorporating this feedback into their ratings, data on their reports, and/or even hardcoding AI oversight into their voting policies.

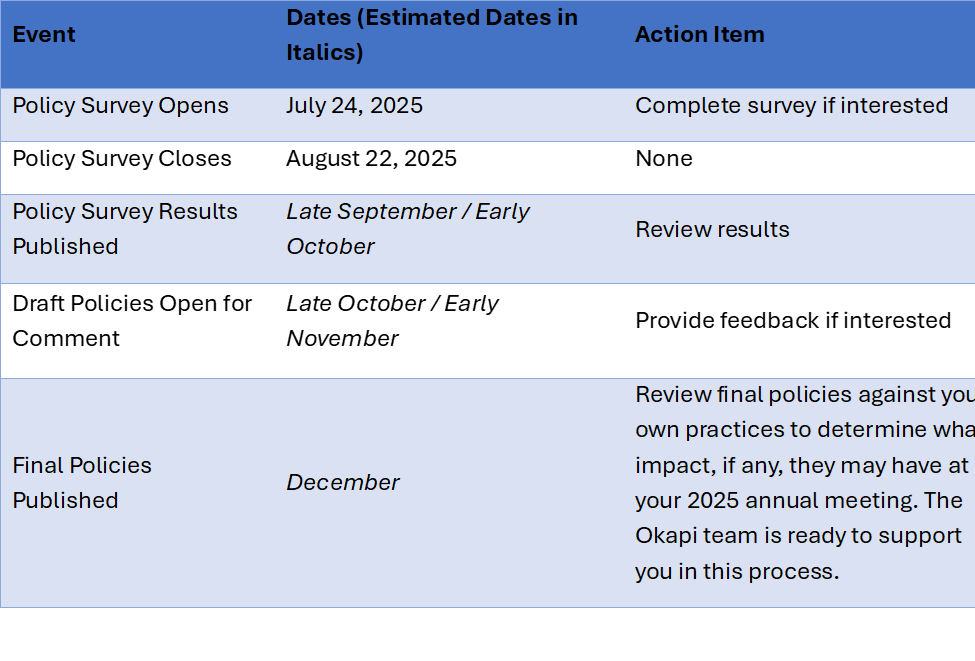

Based on historical timing of the ISS policy update process, below is a timeline of upcoming key dates and action items. Of note, this ISS survey was published earlier than surveys in prior years, so events may occur earlier than usual: